Investing in real estate offers a range of opportunities, from the urban hustle of commercial properties to the serene settings of vacation rentals.

Each type of property comes with its own perks and quirks, making the investment journey both thrilling and rewarding.

Whether you’re eyeing a cozy residential rental or exploring the potential of crowdfunding platforms, there’s something for everyone in the real estate market.

Let’s explore the 7 best types of real estate properties that promise not only financial growth but also a dash of real estate adventure.

1. Commercial Properties

Commercial properties are the playgrounds of big investors. From retail spaces to office buildings, these properties offer higher income potential.

They boast longer lease terms compared to residential properties, providing stability in cash flow. However, they require a knack for business acumen.

These properties can be a bit more challenging to manage, but the rewards are worth it. Understanding market trends and tenant needs is crucial.

After all, nothing beats the feeling of seeing your office building light up as businesses buzz inside.

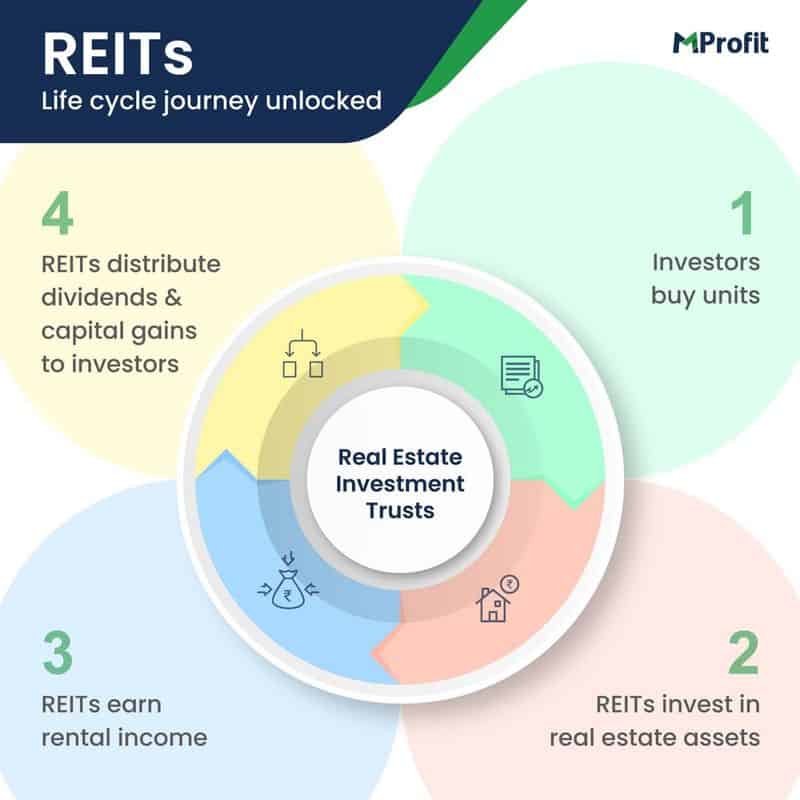

2. Real Estate Investment Trusts (REITs)

REITs are for those who want a slice of real estate without the hassle of direct ownership. These trusts allow you to invest in real estate assets indirectly.

They’re traded on major stock exchanges, making them easily accessible to the average investor. REITs often pay high dividends, as they’re required to distribute most of their income.

The best part? You can diversify your portfolio with various property types. So, if you fancy the real estate game but prefer the stock market, REITs offer the perfect blend of both worlds.

3. Residential Rental Properties

Residential rental properties are the bread and butter of real estate. These properties are typically easy to manage and provide a steady income stream.

Think cozy apartments or charming duplexes where tenants can live their best lives.

For investors, these properties are a solid choice. They’re usually located in areas with high rental demand, promising consistent returns. Plus, with a bit of TLC, they can appreciate over time.

The secret sauce? Picking the right location where renters clamor for space and you, dear investor, can sit back and enjoy the monthly rental checks.

4. Fix-and-Flip Properties

Fix-and-flip properties are for those with a knack for transformation. These investments focus on buying undervalued properties, renovating them, and selling for a profit.

It’s like reality TV, where every renovation brings a new challenge and potential reward. The thrill lies in spotting hidden gems and turning them into polished diamonds.

But beware, it’s not for the faint-hearted. It demands time, effort, and a keen eye for design. If you’re up for the challenge, fix-and-flip properties can be both lucrative and creatively satisfying.

5. Vacation Rentals

Vacation rentals invite investment in paradise. These properties capitalize on the tourism boom, offering short-term stays in scenic locales.

With platforms like Airbnb, managing bookings has never been easier. Guests are drawn to the comfort of homes over hotels, providing a unique stay experience.

These properties require regular upkeep to maintain appeal, and understanding seasonal demand is key.

For those who love the idea of hosting travelers, vacation rentals offer a rewarding way to blend business with leisure.

6. Raw Land and New Construction

Raw land offers a blank canvas for visionary investors. It provides development opportunities, from residential projects to commercial ventures.

The potential is limitless, but it requires vision and patience. Land appreciates as demand grows, making it a top investment choice.

New construction, on the other hand, allows for crafting modern spaces. Investors can tailor properties to market needs, ensuring contemporary appeal.

Both options offer a chance to leave a lasting mark on the landscape, blending creativity with investment strategy.

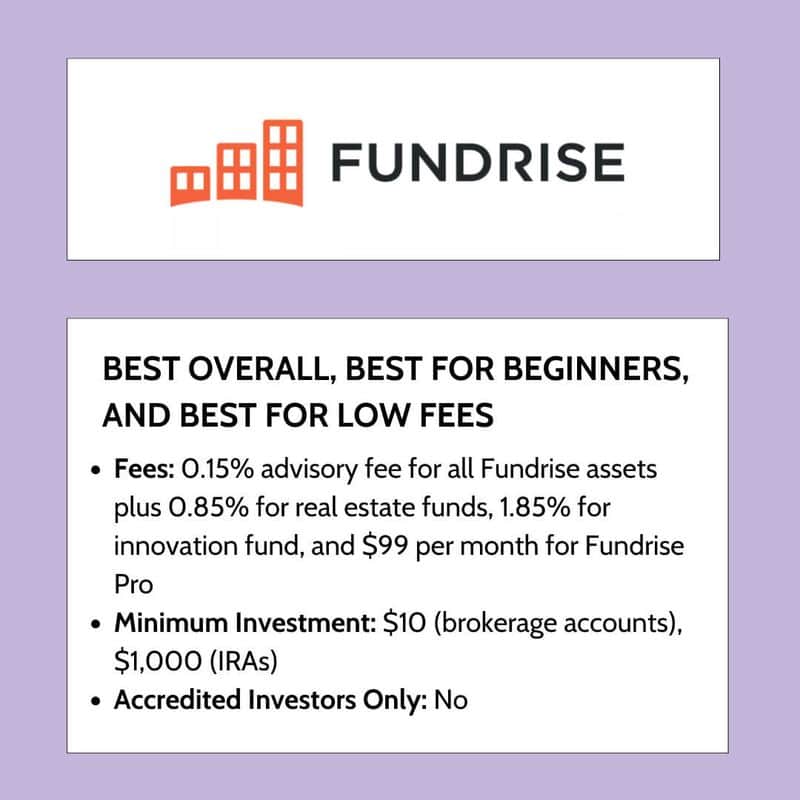

7. Crowdfunding Platforms

Crowdfunding platforms democratize real estate investment. They allow individuals to pool resources and invest in properties collectively.

This is an exciting option for those with limited capital but a strong interest in real estate. Projects range from commercial buildings to residential developments.

Investors can diversify across multiple properties, reducing risk. It’s a community-driven approach where collaboration leads to shared success.

Crowdfunding platforms make real estate accessible, inviting everyone to partake in the investment excitement.